The Federal Funding Accountability and Transparency Act (FFATA) was signed on September 26, 2006. The intent is to empower every American with the ability to hold the government accountable for each spending decision. The end result is to reduce wasteful spending in the government. The FFATA requires information on federal awards (discretionary and formula grants, cooperative agreements, loans, contracts, subgrants, and subcontracts) be made available to the public via a single, searchable website, which is www.USASpending.gov. See 2 CFR Part 170.

System for Award Management (SAM) and Unique Entity Identifier (UEI) Requirements

Unless exempt from the requirements under OMB guidance at 2 CFR Part 25, recipients of Federal funding are required to register with SAM and obtain a UEI. Current recipients are required to keep their SAM registration up-to-date. Recipients are required to update information in SAM annually at a minimum to remain in compliance with the terms and conditions associated with their award.

The UEI number is a unique twelve-digit identification number that identifies entities doing business with the Federal government and assigned based on an organization’s physical location. Organizations may have more than one UEI number, if there are multiple physical locations connected with that organization. Applicants and recipients can receive a UEI number by registering with SAM which will process the registration application within 5 business days.

FFATA Reporting on SAM

SAM is the reporting tool Federal prime awardees (i.e. prime contractors and prime grants recipients) use to capture and report subaward and executive compensation data regarding their first-tier subawards to meet the FFATA reporting requirements. Prime contract awardees will report against sub-contracts awarded and prime grant awardees will report against sub-grants awarded. The sub-award information entered in SAM will then be displayed on www.USASpending.gov associated with the prime award furthering Federal spending transparency.

Who Needs to Report

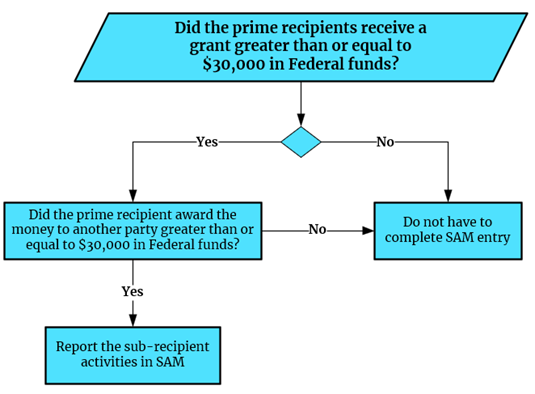

In accordance with 2 CFR Part 170, prime awardees of a federal grant are required to file a FFATA sub-award report by the end of the month following the month in which the prime awardee awards any sub-award equal to or greater than $30,000 in Federal funds that does not include recovery funds. Procurements awarded to provide a service needed by the prime recipient to implement its grant project are not required to be reported in accordance with FFATA. The reporting requirements are as follows:

- Both mandatory (formula) and discretionary grants awarded on or after October 1, 2010.

- All sub-award information must be reported by the prime awardee.

- For those new Federal grants as of October 1, 2010, if the initial award is equal to or over $30,000, reporting of sub-award and executive compensation data is required.

- If the initial award is below $30,000 but subsequent grant modifications result in a total award equal to or over $30,000, the award will be subject to the reporting requirements, as of the date the award exceeds $30,000.

If the initial award equals or exceeds $30,000 but funding is subsequently de-obligated such that the total award amount falls below $30,000, the award continues to be subject to the reporting requirements of the Transparency Act and this Guidance.

FFATA Executive Compensation Requirements

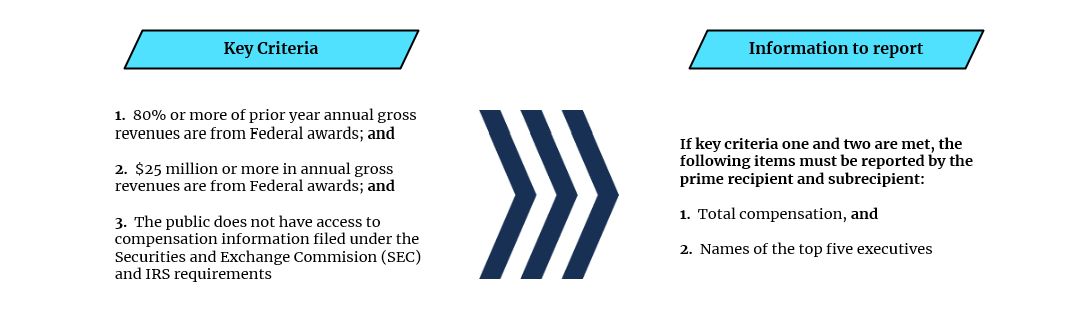

In addition to the reporting requirements outlined for subrecipients, FFATA also includes a requirement for both prime recipients and sub-recipients on reporting executive compensation. Reporting criteria are the same for both prime recipients and sub-recipients, with the only key difference being the system they are reported in.

Unless already entered in SAM by the subrecipient, prime recipients report executive compensation for their subrecipient’s 5 highest paid executives when all three of the following conditions apply in the preceding fiscal year:

FFATA Reporting Timelines

Prime recipients report their first-tier subawards and the first-tier subawards’ executive compensation by the end of the month following the month the subaward or obligation was made.

Example:

The prime recipient makes a subaward on October 1, 2024; the prime recipient must report the subaward and the subrecipient’s executive compensation (if applicable) by November 30, 2024.

Example:

The prime recipient makes a subaward on October 31, 2024; the prime recipient must report the subaward and the subrecipient’s executive compensation (if applicable) by November 30, 2024.

FFATA reports are not cumulative. Cumulative reports will confuse SAM and result in data duplication. Each month’s FFATA report should only contain subawards made within the month prior.